But managing your endowment doesn't have to be.

Smart Endowment Management for Nonprofits

eCIO works exclusively with nonprofits like yours to offer low-cost endowment management solutions.

- Lean on eCIO's experienced advisors.

eCIO's advisors have many years of experience managing endowments for nonprofits like yours. eCIO provides access to a Chief Investment Officer without the additional overhead of staffing. - Enjoy the benefits of a fiduciary advisor relationship.

eCIO has a fiduciary duty to its clients. This means we have a fundamental obligation to put our client's interests before our own. This is an important distinction to understand when selecting an investment advisor. - Manage documents, events, and members on your myecio.com portal account.

Gain access to a robust set of board management tools and access your quarterly, video-based portfolio updates on an easy-to-use online portal. - We work with nonprofits of all sizes.

Our high-tech approach to endowment management gives smaller nonprofits access to low-cost investment services typically reserved for larger organizations ($10K portfolio minimum).

Don't break a sweat worrying about your investment program. Partner with eCIO so you can focus on your mission.

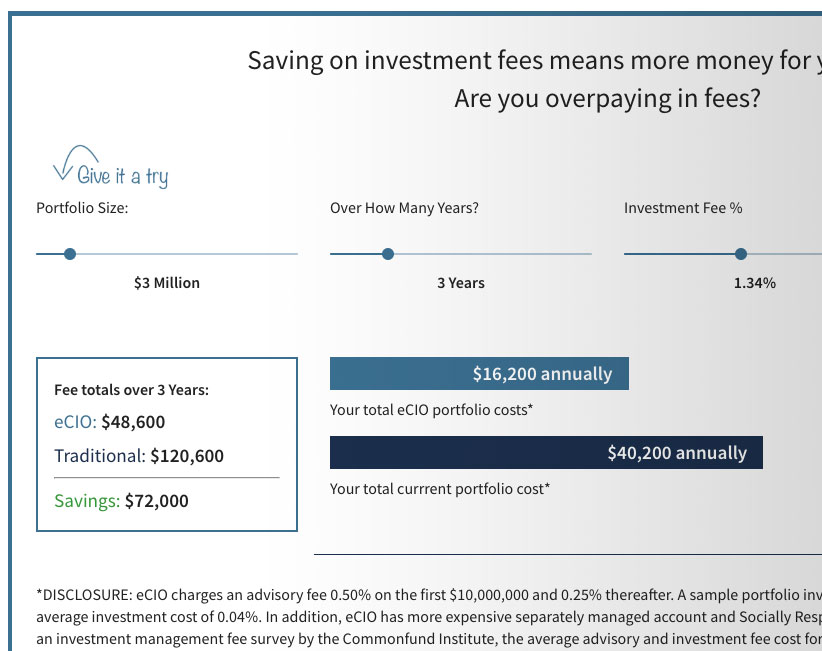

Saving on investment fees means more money for your mission. Are you overpaying in fees?

Investment fees could be taking a bite out of your returns. A difference of half a percent might mean thousands of dollars left on the table*.

*A half a percent on a $1,000,000 portfolio is $5,000.

Questions about eCIO investment fees:

Leveraging technology as an alternative to much of the expensive, behind-the-scenes legwork of traditional endowment management allows us to offer low investment fees to our nonprofit partners. Additionally, we have developed an easy to use, web-based platform that moves communications online rather than relying on costly onsite meetings. This allows us to do more with less and pass those savings on to our customers. There is no catch. Just smart, technology-first innovation. Welcome to the next generation of investing.

eCIO's advisory fee is 0.50% for endowments up to $10 million. Amounts over $10 million are charged 0.25%. For accounts with portfolios less than $500,000, a platform fee of $49 per month is charged in addition to a 0.50% advisory fee.

We have a minimum endowment requirement of $10K. Endowments under $500K are charged a monthly platform fee of $49 in addition to the 0.50% advisement fee.

What Investment Tracks Does eCIO offer?

Passive Track

ESG/Sustainable Track

Separately Managed Accounts (SMA)

Questions about eCIO investment offerings:

We offer three investment tracks. 1) Passive Investments: low-cost ETFs and index funds. 2) ESG/Sustainable investments: ETFs that provide exposure to companies with positive environmental, social and governance characteristics and 3) Actively Managed Investments: Individual securities managed on your behalf.

Learn more at https://getecio.com/investment-tracks.

Leveraging technology as an alternative to much of Yes, we offer low-cost ETFs and index funds. Generally, these are the lowest-cost investment options and offer a diversified portfolio of stocks and bonds. Learn more at https://getecio.com/passive-investment-track.

Many nonprofits want to invest in companies with values that align with the organization's values. An ESG/Sustainable investment strategy considers environmental, social, and corporate governance when selecting companies to purchase. Learn more at https://getecio.com/esg-sustainable-investment-track.

Yes. Actively managed portfolios consist of individual securities managed on your behalf. Learn more at https://getecio.com/sma-separately-managed-account-investment-track.

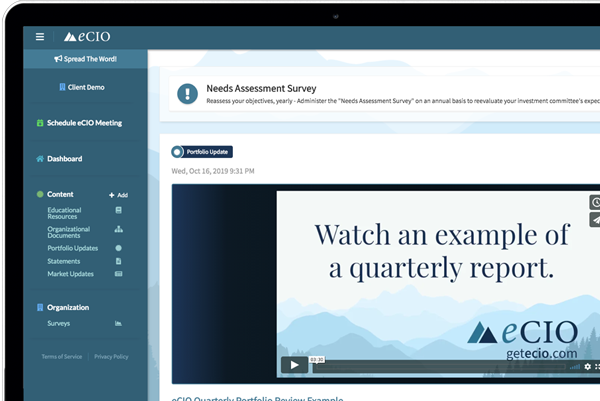

Access quarterly portfolio reviews, market updates, and meet with advisors on the myecio.com portal.

eCIO's technology-first approach streamlines communications giving our customers the flexibility to access information at their convenience.

What are some features available at myecio.com?

Document Management

Event Management

User and Group Management

Questions about the myecio.com portal:

When a nonprofit signs up with eCIO, we create a private, secure online account at myecio.com. Administrators are able to invite board members and staff to their myecio.com portal where they can share documents, schedule meetings and access quarterly portfolio updates.

We evaluated the needs of various organizations and established an infrastructure capable of securely storing data at-scale without clients incurring an additional cost. Our goal is to allow nonprofits to scale as they need without having to worry about additional costs.

Yes. Users can be organized into groups with various levels of access to resources. If you have sensitive documents, you can control which users have access to them.

Organizations can add as many users and groups as needed on their myecio.com platform.

eCIO exceeds industry security standards, ensuring data is secured both in transmission and storage. We adhere to security policies, both internal and external, and rigorously test our platform. All activity on our platform is logged and monitored continuously to ensure that data is being accessed only by parties with permission to do so.

Yes. You have access to an advisor during normal business hours. Simply schedule a meeting in your myecio.com portal.

eCIO is the Chief Investment Officer for Nonprofits.

Low-cost endowment management is just the beginning of the value we offer to nonprofit organizations. Bringing the investment process online allows us to offer a rich set of board oversight and communication tools as well as educational resources including fiduciary obligations and best practices.

Questions about eCIO's offerings:

Yes. eCIO is a Registered Investment Advisor. Registered Investment Advisors have a fiduciary duty to their clients, which means they have a fundamental obligation to put their client's interests before their own.

When choosing an investment advisor, it is important to select a provider that is acting in your best interest.

No. As a fiduciary, we do not work with any investment funds that offer monetary incentives to us. This is an important question to ask your investment manager.

eCIO employees have extensive experience in managing investments for nonprofits. The leader of our firm has the Chartered Financial Analyst (CFA) designation as well as an MBA from the University of Chicago (Finance and Economics). He has been in the investment business for over 30 years.

Yes. We have helped many nonprofits design and implement investment programs. We begin by surveying your investment committee to establish their risk tolerance and expectations for your investment program. From there, we recommend an appropriate asset allocation and draft the documents needed for a successful investment program. After your portfolio has been implemented, we will monitor and rebalance your investments as needed and provide quarterly, video-based portfolio performance reviews on your myecio.com portal. Your advisor is one click away should you have any questions.

Most endowment funds can be established in a week or less. The time it takes to establish an endowment fund is generally driven by your organization’s governance process and whether board approval is needed to hire an investment advisor.

eCIO can work with nonprofits across the United States. We are headquartered in Madison, WI and have support services in Tampa, FL.

We do not require any long term commitments. Customers are free to discontinue their services at any time.

Our appointment scheduler can be accessed here: https://calendly.com/ecio/demo. Please select the date and time that works best for you. We use an online video platform for our presentations that allows us to demonstrate how eCIO works.

Yes. We frequently complete RFP's for prospective clients. Please schedule an appointment for a demonstration so we can discuss your requirements further: https://calendly.com/ecio/demo.

Ready to see eCIO in action?

See why nonprofits are choosing eCIO over traditional endowment managers.

Not quite ready to talk to a live person?

©2020 eCIO, Inc. All rights reserved.

https://getecio.com · hello@getecio.com · (608) 291-4646

821 E Washington Ave Suite 200 Madison, WI 53703

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Service and Privacy Policy.

eCIO, Inc (“eCIO”) is a registered investment adviser located in Madison, Wisconsin. eCIO may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. eCIO’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of eCIO’s web site on the Internet should not be construed by any consumer and/or prospective client as eCIO’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by eCIO with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of eCIO, please contact the state securities regulators for those states in which eCIO maintains a registration filing. A copy of eCIO’s current written disclosure statement discussing eCIO’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from eCIO upon written request. eCIO does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to eCIO’s web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

This website and information are provided for guidance and information purposes only. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.